Major Currencies

Remit in 16 major currencies

“I am very impressed with Suryoday Bank. My Savings Account was opened in no time and got my debit card immediately. Now, I am doing transactions very easily. I get text messages for all my transactions. I can avail statement at any time via Mobile Banking App. Staff is very supportive.”

Maheshwari P

Salem, Tamil Nadu

Remit in 16 major currencies

Initiate online wire transfer

Competitive Conversion Rate

For Outward Remittance

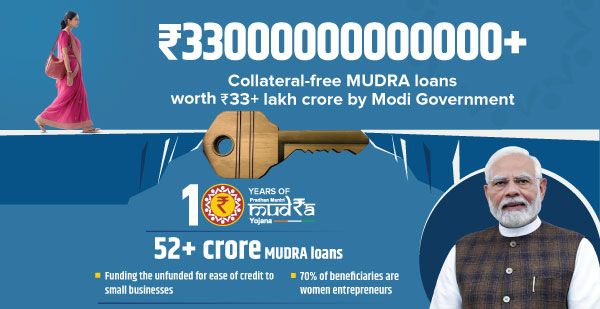

The Finance Act, 2020 amended Section 206C of the Income Tax Act,1961 and introduced tax collection at source (TCS) on foreign remittance under LRS subject to the applicable threshold limit. TCS@20%* shall be applicable on all forex drawls under LRS exceeding INR 7 Lakhs in a financial year.*For remittances towards pursuing overseas education, TCS @ 0.5% shall be applicable, if the amount remitted is obtained through an educational loan from a financial institution as specified u/s 80E of the Income-tax Act, 1961. However, if the amount remitted towards overseas education is from out of own funds or loan from any other entity (i.e. not from education loan obtained from a financial institution as explained above), TCS@5% shall be applicable on remittance amount exceeding INR 7 lakhs each financial year. If you are eligible to pay TCS on a certain transfer, then a separate TCS amount will be shown in break-up of charges.

Exciting rewards ready to delight you

Enjoy year-round offers across various categories

Save as you prioritize your needs

Exciting offers for your festive shopping cart

Wrap a smile for your sister

Gift your dad a special memory

Show your mom you care

An exclusive curation of banking and lifestyle privileges to match your class, ambition and aspiration.

for Senior Citizen

for Others

*Disclaimer – Interest rates are subject to change.

Please select popup template